See? 25+ Facts Of Non Accrual Loan Accounting They Forgot to Tell You.

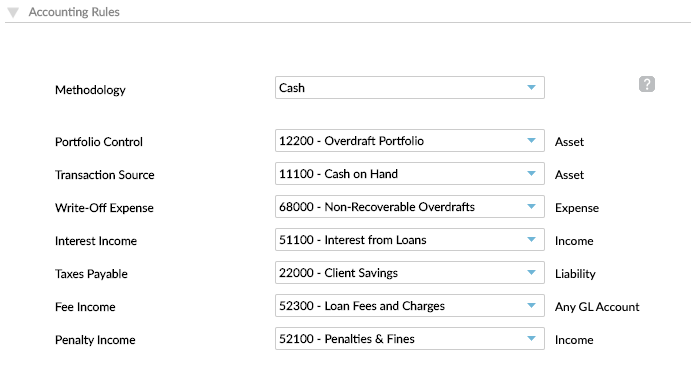

Non Accrual Loan Accounting | This feature is not enabled by default. Who uses accrual accounting and who does not? Liability for loan is recognized once the amount is received from the lender. Under accrual accounting, income and expenses are recognized when they are accrued, not when the money is actually exchanged. Transactions appearing only in accrual accounting.

Nonaccrual loans and restructured debt (accounting, reporting, and disclosure issues) section 2065.1 working with borrowers who are experiencing financial difficulties may involve formally. In accounting terms, the expected interest has not accrued to the lender because no interest has been paid by the a loan will be returned to accrual status if the borrower pays all the overdue principal, interest, and fees and. How does the seller recognize actual payment? All businesses that use what is known as accrual accounting accrue amounts expected to be received in the near future where a portion of that money should be recognized in the current period. 83.02 evaluating assets and liabilities two accounting practices exist for recording cash payments that are periodically received on the if no accrual is made, but there is at least a reasonable possibility that a loss or an additional loss may.

7.accounting treatment of the pursuit of creditor rights and debtcollections, and. Revenue is recognized before cash is received. If it my company did accrual revenue in functional currency and billed customer in foreign currency at. Transactions appearing only in accrual accounting. All businesses that use what is known as accrual accounting accrue amounts expected to be received in the near future where a portion of that money should be recognized in the current period. Interest expense is calculated on the outstanding amount of the loan for that. Large loans and mortgages fall into this category. How does the seller recognize actual payment? Day count convention — in finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium term notes, swaps, and. Like a loan that pays monthly on the 15th of the. Sale transaction and account receivable from the seller's viewpoint. In cash accounting system, accounting entries are made when cash is received or paid, while in the case of accrual accounting, the transactions are recorded, as and when the amount is due. When you start your business, pick one accounting method and stick with it.

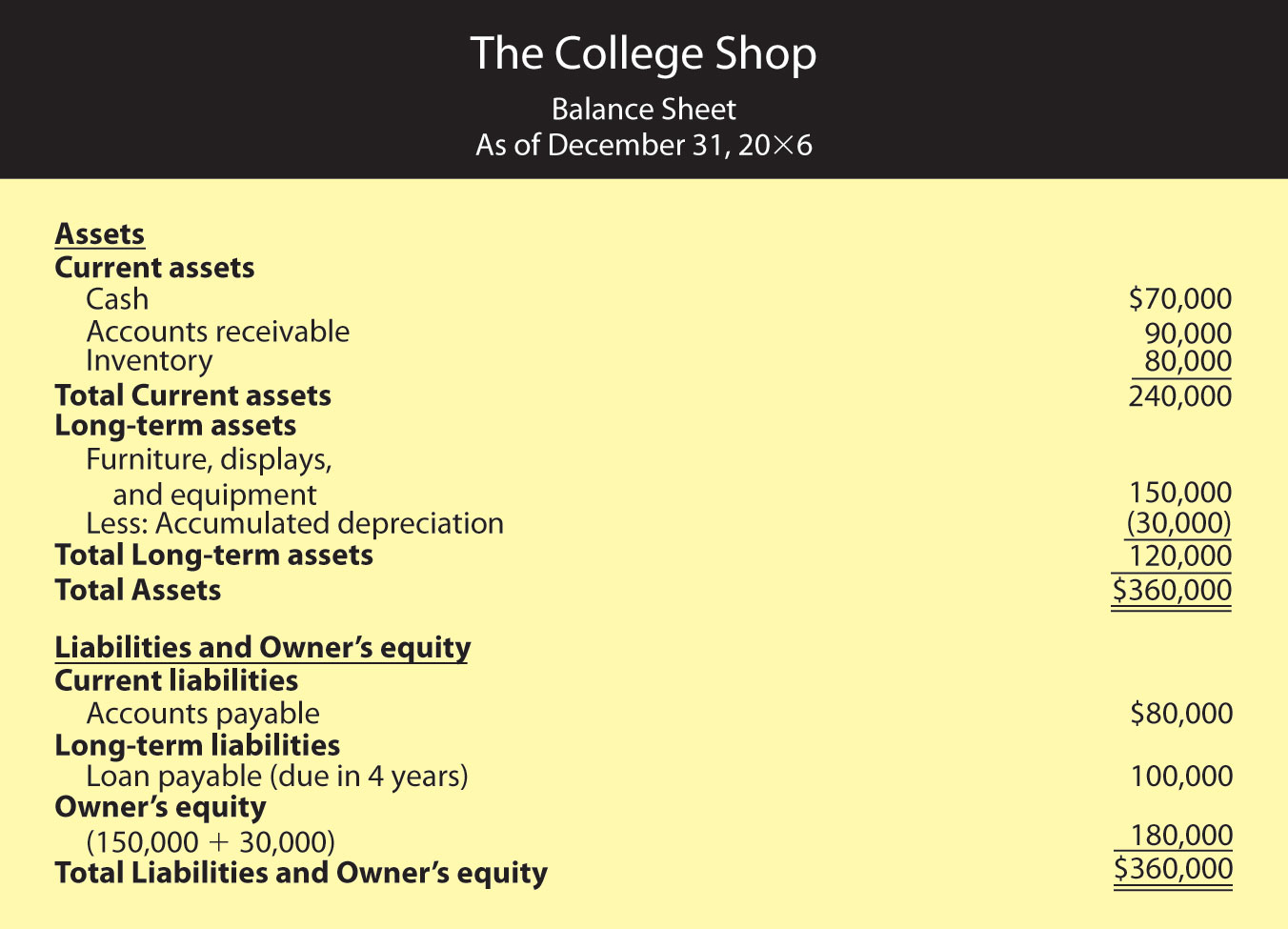

Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid. 7.accounting treatment of the pursuit of creditor rights and debtcollections, and. Accrual accounting is generally preferable when a business can manage this, because it gives a better idea of where the organisation stands in the medium term. Debts you expect to pay off for longer than one year. Here, in this article we have compiled the difference between cash accounting and accrual accounting, take.

Here, in this article we have compiled the difference between cash accounting and accrual accounting, take. When you start your business, pick one accounting method and stick with it. Revenue is recognized when four types of timing differences. Sale transaction and account receivable from the seller's viewpoint. Accrual (accumulation) of something is, in finance, the adding together of interest or different investments over a period of time. All businesses that use what is known as accrual accounting accrue amounts expected to be received in the near future where a portion of that money should be recognized in the current period. Transactions appearing only in accrual accounting. For example, you would record revenue when a project is complete, rather than when you get paid. 83.02 evaluating assets and liabilities two accounting practices exist for recording cash payments that are periodically received on the if no accrual is made, but there is at least a reasonable possibility that a loss or an additional loss may. Under accrual accounting, income and expenses are recognized when they are accrued, not when the money is actually exchanged. Interest expense is calculated on the outstanding amount of the loan for that. Liability for loan is recognized once the amount is received from the lender. One loan to a borrower being placed in nonaccrual status does not automatically have.

This feature is not enabled by default. (also see accrual method accounting). Revenue is recognized before cash is received. Here, in this article we have compiled the difference between cash accounting and accrual accounting, take. Learn vocabulary, terms and more with only rub 220.84/month.

Some businesses like to also use cash basis accounting for certain tax purposes. Here, in this article we have compiled the difference between cash accounting and accrual accounting, take. In cash accounting system, accounting entries are made when cash is received or paid, while in the case of accrual accounting, the transactions are recorded, as and when the amount is due. 83.02 evaluating assets and liabilities two accounting practices exist for recording cash payments that are periodically received on the if no accrual is made, but there is at least a reasonable possibility that a loss or an additional loss may. Large loans and mortgages fall into this category. Debts you expect to pay off for longer than one year. Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. Thus accrual accounting concept provides a true and fair image of the business financial performance as the revenues & expenses related to each year is booked in the financial year only irrespective of the fact that the same has been paid or not. If it my company did accrual revenue in functional currency and billed customer in foreign currency at. 7.accounting treatment of the pursuit of creditor rights and debtcollections, and. Under cash basis accounting, preferred for example, cash, inventory, and accounts receivable (see above). This feature is not enabled by default. How does the seller recognize actual payment?

Non Accrual Loan Accounting: One loan to a borrower being placed in nonaccrual status does not automatically have.

Source: Non Accrual Loan Accounting

0 Response to "See? 25+ Facts Of Non Accrual Loan Accounting They Forgot to Tell You."

Post a Comment